The classic home-buying journey seems to be changing, notes Broker Clinton Howell. There used to be a predictable path: begin with a starter home, build equity, and eventually move into your “forever” home.

“Now more and more buyers are choosing to leapfrog the traditional process, opting to buy their forever home first,” he says. “Burlington’s real estate market has always been competitive, but over the past few years, a combination of factors has changed how buyers are thinking. Rising prices, limited inventory, and the emotional toll of moving multiple times have made a compelling case for settling down sooner rather than later.”

First homes vs. forever homes

First homes tend to share a few common traits. Traditionally, they are more budget-friendly, with entry-level prices. They have smaller square footage and fewer bedrooms and bathrooms. They’re also likely to have basic finishes and fewer upgrades.

First homes may also require some cosmetic updates, offer limited storage or outdoor space, and are often located in up-and-coming or more affordable areas. Buyers who purchase these homes tend to be more focused on getting into the market and building equity.

In years past, we’d see first-time buyers entering the market with condominiums or apartments, which are more affordable and require lower maintenance; stacked or smaller townhomes, with limited square footage, shared walls, and less outdoor space; or older bungalows or semis, which, while more budget-friendly, might need updates or renovations. “These homes were seen as temporary solutions—a place to build equity and eventually move up,” says the REALTORⓇ.

Forever homes, by contrast, tend to have a larger, more spacious layout. They are designed for growing families and long-term comfort. There are more bedrooms and bathrooms to grow into, upgraded finishes and features like a custom kitchen or luxury bathrooms, and ample storage. They boast a desirable location and are in walkable neighbourhoods, close to schools. They include outdoor space, possibly a yard or garden, and are designed with lifestyle and aging-in-place in mind.

Now many first-time buyers are instead starting out with 3- or 4-bedroom detached homes, which are ideal for families and offer room to grow; newer or upgraded townhomes with more space that feature multi-level, open-concept layouts and finished basements; homes with home offices, backyards, and finished basements; and properties in desirable school districts or walkable neighbourhoods. They are no longer prioritizing affordability above all else.

Skipping the starter home: A growing trend

While this isn’t true for everyone, Clinton clarifies, there are several factors contributing to this shift, which he traces back to the early stages of the pandemic. People had more flexibility in location and could prioritize lifestyle thanks to remote work. Record-low interest rates at the time made carrying larger mortgages more manageable. And the uncertainty of the market had people wanting to “buy once and buy right” instead of planning to move again in a few years.

“For many first-time buyers, especially couples or young families, the idea of moving multiple times feels exhausting, financially and emotionally. They’re looking for more stability, more space, and a home that won’t just suit them now, but well into the future. Instead of compromising on location or layout, they’re stretching a little further to secure what they really want from the beginning,” says Clinton.

Affordability

There is definitely a notable price difference between these two types of homes. In a market like Burlington, the gap can be significant.

Starter homes tend to be located in higher-density areas, close to transit, and may be part of older subdivisions. They often offer more affordable entry points:

- Condos/apartments: $480,000 – $650,000

- Townhomes/condo towns: $700,000 – $850,000

- Older semi-detached or modest bungalows: $800,000 – $950,000

Forever homes are often situated on larger lots and are found in more established, low-turnover residential areas where buyers often plan to stay for 10 years or more. These homes come at a higher price:

- Detached homes (3-4 bedrooms): $1.3 million – $1.8 million+

- Larger, newer townhomes with premium finishes: $900,000 – $1.2 million

- Properties in premium areas (near top schools, parks, lakefront): $1.6 million and up

Usually, a much larger down payment is required. “Many buyers aren’t doing it alone,” says Clinton. “The financial strategy behind this trend often includes a mix of family support, creative financing, and shifting lifestyle decisions.”

While not all first-time buyers can afford this leap, those who make it work typically do so with help and strategy; it’s rarely a solo effort. The traditional route still exists, but increasingly, buyers who have strong dual incomes, financial support, or flexibility are choosing to go all-in on their long-term vision from the start.

Says Clinton, “For those considering a move to Burlington, the message is clear: the dream of a forever home doesn’t have to wait. With the right strategy, the right support, and the right timing, many are finding that their first home can, in fact, be their last move for a long time.”

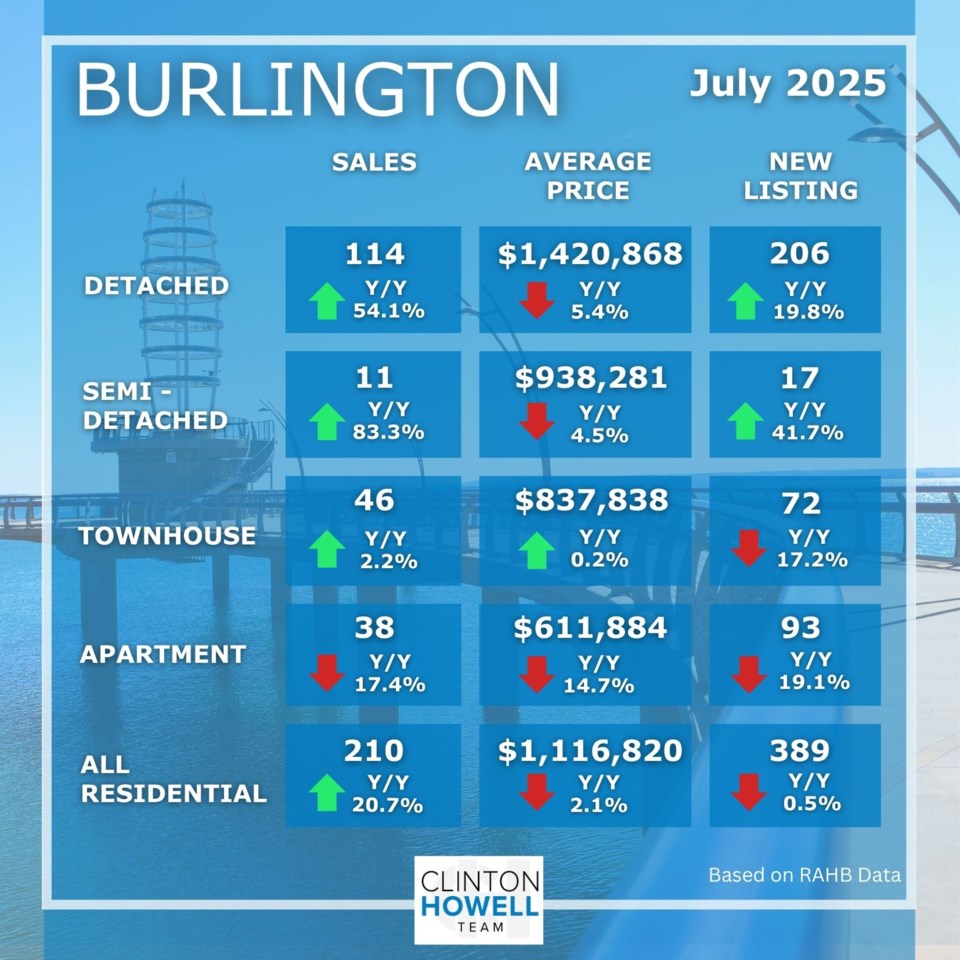

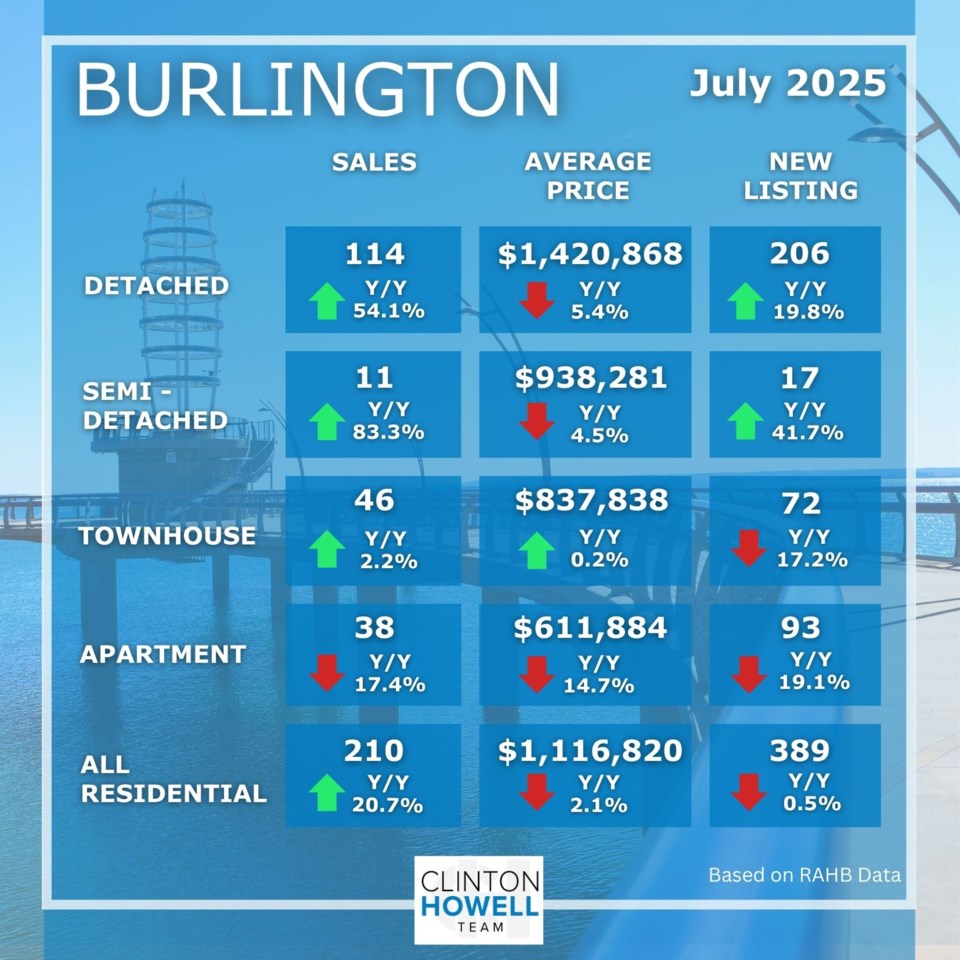

JULY 2025 update: Burlington

Broker Clinton Howell has helped hundreds of buyers purchase their dream home in Burlington, Waterdown, Ancaster and beyond, guiding them each step of the way.

To view the latest listings, visit RE/MAX Escarpment Realty or call 905-537-2246. Watch Howell’s weekly real estate market updates on YouTube. You can also follow him on LinkedIn, Instagram, and Facebook.