The city’s two major hospitals are among nine regional health care facilities reporting budget surpluses for 2009-10.

St. Joseph’s Hospital leads all Northwestern Ontario hospitals in fiscal prudence, declaring a $3.62 million surplus for the year ending March 31. Thunder Bay Regional Health Sciences Centre was No. 2 regionally, with $861,835 left in the bank, according to figures provided by the North West Local Health Integration Network.

Also in the black were hospitals in Dryden, Atikokan, Geraldton, Kenora, Nipigon, Red Lake and Sioux Lookout.

Four hospitals in the region reported a deficit, led by the $1.11-million shortfall at Fort Frances’ s Riverside Health Care Facilities.

Others coming up short include Manitouwadge General Hospital ($273,197), The McCausland Hospital in Terrace Bay ($38,153) and Wilson Memorial General Hospital in Marathon ($190,442).

Provincially, 61 of 159 hospitals, or 38 per cent showed deficits, totaling $107 million. The year before the same number of hospitals reported losses totaling $154 million. By law Ontario’s hospitals are not allowed to run deficits.

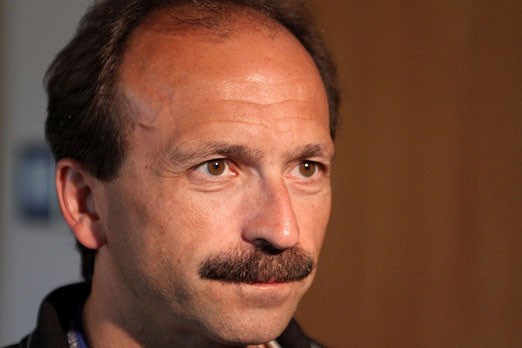

Scott Potts, senior vice-president of corporate services at the Regional Hospital, said according to their books the surplus is actually about $139,000, noting the LHIN’s doesn’t factor depreciation into their numbers.

However, any amount of excess money left over from their $280-million budget is a good thing he added.

“We had planned to be close to break even in operations. It’s a little bit on the favourable side, so it’s good news for the organization and we’re happy with the result,” he said on Monday.

It’s the fourth straight year the hospital has operated with a surplus.

It’s a far cry from the deficits faced by some hospitals across the province. Peterborough Regional Heath Centre was $14 million shy of hitting its target, while Sault Area Hospital in Sault Ste. Marie was $13.6 million short.

Potts said none of the Regional Hospital’s savings were realized at the expense of patient services.

“We haven’t reduced any services,” he said. “Again, we’ve just been very diligent about our own financial situation and monitoring our expenses, maximizing our revenue. So we’ve done well compared to some other hospitals.”

Janet Sillman, vice-president of mental health and addictive services at St. Joseph’s Care Group, cautioned not to read too much into their surplus, noting it only applies to St. Joseph’s and Lakehead Psychiatric hospitals, not their entire operation which includes money-losing long-term care beds.

Sillman added that money was budgeted to bring in psychiatrists and other professionals to the LPH, but when no candidates were found, the money simply wasn’t spent.

“Then we have a surplus in the budget,” she said, adding that at just 71 beds and shrinking, they are also realizing surpluses in operating costs.

Knowing tough times are coming, with the province suggesting they would only increase hospital allocations by 1.5 per cent and inflation doubling that at times, Potts said health care facilities will have to be even more prudent in years to come.

On that end he said hospitals in the North West LHIN are planning to join forces and form a large-scale purchasing group to cut costs on supplies and equipment.

Susan Pilatzke, the acting CEO of the North West LHIN said her organization works closely with hospitals under watch, and said relatively speaking the region is lucky, with just 30 per cent of its hospitals reporting a deficit last year, only one above $275,000.

However, she added, smaller hospitals will often feel forced savings harder than larger hospitals, with much larger operating budgets.

The key is staying on top of things, Pilatzke said.

“Communication is regular so there are no surprises,” she said. “Ultimately we’re always understanding of what the pressures are and continue to help set strategies to move forward.”

St. Joseph’s Hospital leads all Northwestern Ontario hospitals in fiscal prudence, declaring a $3.62 million surplus for the year ending March 31. Thunder Bay Regional Health Sciences Centre was No. 2 regionally, with $861,835 left in the bank, according to figures provided by the North West Local Health Integration Network.

Also in the black were hospitals in Dryden, Atikokan, Geraldton, Kenora, Nipigon, Red Lake and Sioux Lookout.

Four hospitals in the region reported a deficit, led by the $1.11-million shortfall at Fort Frances’ s Riverside Health Care Facilities.

Others coming up short include Manitouwadge General Hospital ($273,197), The McCausland Hospital in Terrace Bay ($38,153) and Wilson Memorial General Hospital in Marathon ($190,442).

Provincially, 61 of 159 hospitals, or 38 per cent showed deficits, totaling $107 million. The year before the same number of hospitals reported losses totaling $154 million. By law Ontario’s hospitals are not allowed to run deficits.

Scott Potts, senior vice-president of corporate services at the Regional Hospital, said according to their books the surplus is actually about $139,000, noting the LHIN’s doesn’t factor depreciation into their numbers.

However, any amount of excess money left over from their $280-million budget is a good thing he added.

“We had planned to be close to break even in operations. It’s a little bit on the favourable side, so it’s good news for the organization and we’re happy with the result,” he said on Monday.

It’s the fourth straight year the hospital has operated with a surplus.

It’s a far cry from the deficits faced by some hospitals across the province. Peterborough Regional Heath Centre was $14 million shy of hitting its target, while Sault Area Hospital in Sault Ste. Marie was $13.6 million short.

Potts said none of the Regional Hospital’s savings were realized at the expense of patient services.

“We haven’t reduced any services,” he said. “Again, we’ve just been very diligent about our own financial situation and monitoring our expenses, maximizing our revenue. So we’ve done well compared to some other hospitals.”

Janet Sillman, vice-president of mental health and addictive services at St. Joseph’s Care Group, cautioned not to read too much into their surplus, noting it only applies to St. Joseph’s and Lakehead Psychiatric hospitals, not their entire operation which includes money-losing long-term care beds.

Sillman added that money was budgeted to bring in psychiatrists and other professionals to the LPH, but when no candidates were found, the money simply wasn’t spent.

“Then we have a surplus in the budget,” she said, adding that at just 71 beds and shrinking, they are also realizing surpluses in operating costs.

Knowing tough times are coming, with the province suggesting they would only increase hospital allocations by 1.5 per cent and inflation doubling that at times, Potts said health care facilities will have to be even more prudent in years to come.

On that end he said hospitals in the North West LHIN are planning to join forces and form a large-scale purchasing group to cut costs on supplies and equipment.

Susan Pilatzke, the acting CEO of the North West LHIN said her organization works closely with hospitals under watch, and said relatively speaking the region is lucky, with just 30 per cent of its hospitals reporting a deficit last year, only one above $275,000.

However, she added, smaller hospitals will often feel forced savings harder than larger hospitals, with much larger operating budgets.

The key is staying on top of things, Pilatzke said.

“Communication is regular so there are no surprises,” she said. “Ultimately we’re always understanding of what the pressures are and continue to help set strategies to move forward.”