THUNDER BAY – Homeowners in the city can expect a 3.51 per cent increase in their property taxes for 2025.

For a single-family detached home assessed at $219,000, the median for Thunder Bay, the tax bill will increase by $137.97 over last year.

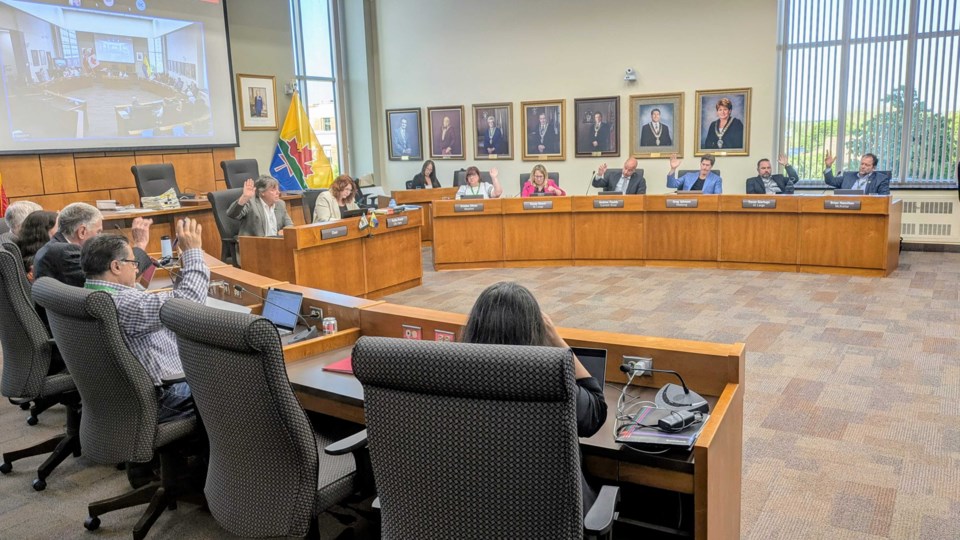

In an 8-5 vote, council voted to maintain the city's existing tax ratios against the advice of city staff who recommended decreasing the proportion of taxes paid by industrial, commercial and multi-residential property owners as a way to encourage growth in those sectors.

Councillors Shelby Ch'ng, Albert Aiello, Trevor Giertuga, Andrew Foulds, Rajni Agarwal, Dominic Pasqualino, Michael Zussino, and Kasey Etreni voted in favour.

Couns. Brian Hamilton, Mark Bentz, Kristen Oliver, Greg Johnsen, and Mayor Ken Boshcoff voted against the status quo option.

That's a reversal for Pasqualino, who voted against the motion last week when the 2025 tax policy failed to get approval in a 6-6 stalemate.

Ch'ng was not at the June 16 meeting, and council opted to defer the decision to Monday night’s meeting when all councillors were present.

If council had voted in favour of staff's recommendation, the tax rate would have gone up 3.7 per cent and the tax bill for a median-valued home would have been about $8 higher.

“$8 is maybe not much to us, but to some people, when their taxes have gone up through the 2016 assessment that is staggered over years, it's significant, and to just minimize it as being $8, it's not, to me, appropriate. We've been doing this over and over for years, so it's a very cumulative impact on the people,” Giertuga said.

Nobody likes voting for an increase, said Boshcoff, but “if you don't come to grips with it sooner, when it comes up next year, it's gonna be worse.”

“You can put it off for a year and then have to do something in double digits just to catch up again. Well, I would sooner that we be a smart city that does it slowly and modestly with stability and presents that. It would be wonderful to vote against this, and that's my natural inclination.”

“But, we have a professional public service. People want fire, police and ambulance protections, and they want all the other services. I rarely get someone calling me saying, you know, we have too many services, or my street's being plowed too often. It just doesn't happen. There's only one way to do that is you have to pay for it.”

“I hear from some people, that is almost a mantra, that we are a city in decline. However, when I speak to anyone looking for a house or people looking for commercial property or people raking in the cash because their business is doing so well, they tell me the opposite,” Ch’ng said.

“So, I'm wondering if we could get a sense from administration, what the actual state of our city is? Is it decline, stagnation, increase?”

City manager John Collin said no. The city of Thunder Bay is not in decline.

“I've never used the term that the city is in decline, and I don't believe it to be true. I think what is true is that our property tax base has grown by 7.8 per cent over the last 10 years, cumulative, and inflation has grown by 32 per cent. So, we are not keeping up with inflation, and that is putting pressure on everything, but we're not in decline,” Collin said.

“We are growing on a yearly basis, just not enough, and the potential for future growth is tangible, factual, and so long as we work on it, we should achieve that. The city is not in decline. We are growing every year. We're not growing enough, but we can grow more and have a growth rate that deals with the inflationary pressures that we experience on a yearly basis, that families experience on a yearly basis, and that businesses experience on a daily basis.”

The city's tax levy, the total amount collected in property taxes, increased 4.5 per cent this year over 2024. That was set when council approved the budget in February.

Growth in the city's tax base and the higher tax rates paid by other property classes make up the difference between the 4.5 per cent in tax levy increase and the 3.5 per cent residential tax rate increase.

Tax rates for other property classes are set relative to the residential rate. The multi-residential rate is 1.99 times higher, the commercial rare is 1.98 times higher and the large industrial is reduced from 2.73 time higher.

The tax policy still needs to be ratified at a future meeting of council.