Tax cheaters in the underground economy have a lot to potentially lose: their homes, their business and their freedom.

Get caught and found guilty and not only could they face restitution and fines, but could also be locked away for up to five years.The public faces its own set of dangers, including liability and shoddy workmanship that could lead to much higher costs in the long run.

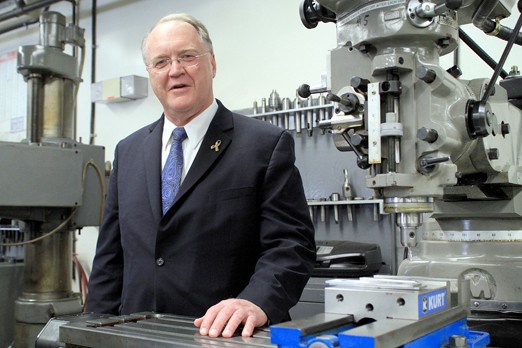

Keith Ashfield, the Conservative minister of national revenue, on Thursday said his government is expanding its efforts to restore hundreds of millions of missing dollars to the federal tax rolls. The missing money has a heavy effect on the Canadian economy and hampers the federal government’s ability to provide services from one end of the country to the other.

“We’re trying to make people aware of the risks,” Ashfield said during a stop at Confederation College, a pre-cursor to closed-door pre-budget discussions the Tories are holding country-wide in advance of an expected March 22 federal budget.

“It also has a major effect on the economy of Canada, because those unpaid taxes that should be going into the revenues of the country, to things like health and education and a lot of things we take from granted in this country.”

The blitz follows an awareness program unveiled in Atlantic Canada, aimed at keeping the dangers of the underground economy top of mind.

Once its effect has been studied, Ashfield said similar programs could be rolled out across Canada.

He added the feds have worked diligently to uncomplicated the tax system, removing more than 8,000 obsolete forms from the process, an effort to convince underground businesses to go legit.

Locally contractors involved with the Thunder Bay Home Builders Association were either unavailable Thursday or unwilling to say much about how much of an impact the underground economy has on the Thunder Bay market.

John Simperl, a TBHBA board member, said he doesn’t see too much of an effect in his line of work – he works for Bruno’s Contracting – but understands it does impact many of the association’s legitimate companies.

Simperl said provincial and federal sales taxes, harmonized into a single tax last July, are high enough to convince law-abiding citizens to seek a less expensive option.

“Basically, with this 13 per cent tax, if somebody can get around it they’re going to try to save 13 per cent,” he said.

Ashfield, whose home province of New Brunswick adopted the HST in 1997, said he thinks it provided an initial spike to the underground economy, but that’s since tapered off.

“It’s not as big an issue, but again, it’s all part of the education process and understanding,” Ashfield said.

Ashfield also used the occasion to encourage the public to report people skirting the country’s tax laws or to make amends for past scofflaw activities through the voluntary disclosure program.

Sign in or register

- Messages

- Post a Listing

- Your Listings

- Your Profile

- Your Subscriptions

- Your Likes

- Your Business

- Support Local News

- Payment History

Registered Users

Already have an account?

New Users

Create a free account.